Don’t have this issue? Get it in the Maker Shed.

The Crypto Currency Tracker monitors the value of three different digital currencies — Bitcoin, Litecoin, and Dogecoin — and compares them each against the United States dollar.

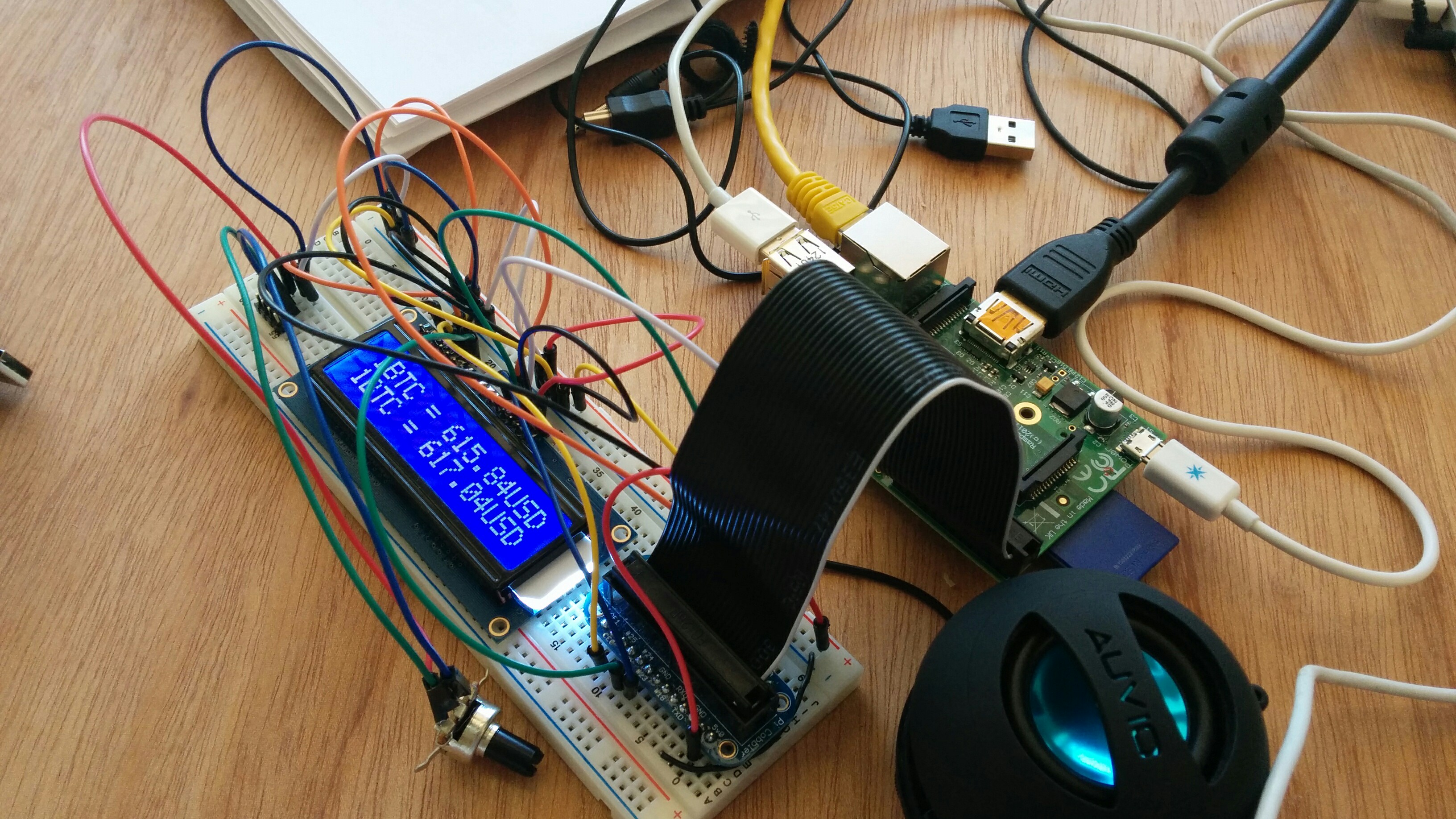

The hardware consists of a Raspberry Pi, a 16×2 Liquid Crystal Display (LCD), an SD card, Ethernet cabling, and a USB micro cable with wall wart for power. The tracker’s software is built on Raspbian Linux and uses existing Python libraries to control a Hitachi LCD controller combined with our tracker’s Python scripts, which make JavaScript Object Notation (JSON) requests for each respective digital currency market index.

Not only does the code pull digital currency values from the internet, but it also stores the old value in a variable called,

self.last_price Retention of the last value is done to display it on the lower line of the 16×2 LCD; the top line is the current value.

The image below shows Bitcoin, or BTC, with a USD current value of 587.46 and a previous value of 587.22.

Cryptocurrency Background

While the tracker works regardless of a user understanding of the markets it tracks, knowing a bit about cryptocurrencies is interesting and not terribly difficult — well, except for the mathematical proofs, but that’s way beyond the scope of this primer.

History

Cryptocurrencies have been around since 2009 with the emergence of a paper by Satoshi Nakamoto outlining the Bitcoin protocol (https://bitcoin.org/bitcoin.pdf). While mention of a cryptocurrency occurred in the late ’90s, there was no implementation until Bitcoin.

In 2011, following on the technological successes of Bitcoin and seeking to improve some observed shortcomings, Litecoin was created.

One feature of cryptocurrencies is a restriction on the number of coins that can exist, which of course is dissimilar from currencies run by central banks where there is no absolute restriction on the number of coins in the market. Litecoin’s maximum coin count is 84 million, whereas Bitcoin max is 21 million coins. This difference, along with a few other changes, allow for Litecoins to be more easily mined.

And then there is Dogecoin. Appearing first in late 2013, this meme-inspired digital currency, with a Shiba Inu dog as mascot and Comic Sans as its mandated typeface, puts fun first. Far surpassing both Bitcoin and Litecoin in the maximum coin limit, Dogecoin does not cap off until at least 100 billion units! This shear count combine with Doge riding a rocket gives purchase to the popular Dogecoin slogan, “To the Moon!

How are bitcoins created?

As the Bitcon Frequently Asked Questions succinctly explains:

New Bitcoins are generated by a competitive and decentralized process called “mining”. This process involves that individuals are rewarded by the network for their services. Bitcoin miners are processing transactions and securing the network using specialized hardware and are collecting new Bitcoins in exchange.

The Bitcoin protocol is designed in such a way that new Bitcoins are created at a fixed rate. This makes Bitcoin mining a very competitive business. When more miners join the network, it becomes increasingly difficult to make a profit and miners must seek efficiency to cut their operating costs. No central authority or developer has any power to control or manipulate the system to increase their profits. Every Bitcoin node in the world will reject anything that does not comply with the rules it expects the system to follow.

Bitcoins are created at a decreasing and predictable rate. The number of new Bitcoins created each year is automatically halved over time until Bitcoin issuance halts completely with a total of 21 million Bitcoins in existence. At this point, Bitcoin miners will probably be supported exclusively by numerous small transaction fees.

https://bitcoin.org/en/faq#how-are-bitcoins-created

Additional Cryptocurrency Information

For more information on any of the digital currencies, check out bitcoin.org, https://litecoin.org, and http://dogecoin.com.

An especially helpful resource is https://bitcoin.org/en/vocabulary, covering most of the basic vocabulary necessary for discussing cryptocurrencies.